tax loss harvesting crypto

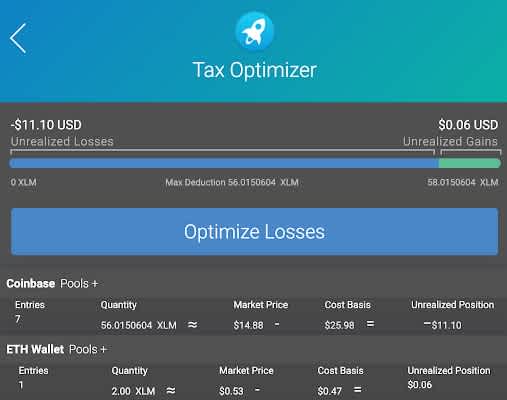

How can I get started with tax-loss harvesting. Connect wallets and exchanges.

How To Save On Crypto Taxes Cryptocurrency Tax Loss Harvesting Explained Youtube

This strategy is named crypto tax-loss harvesting.

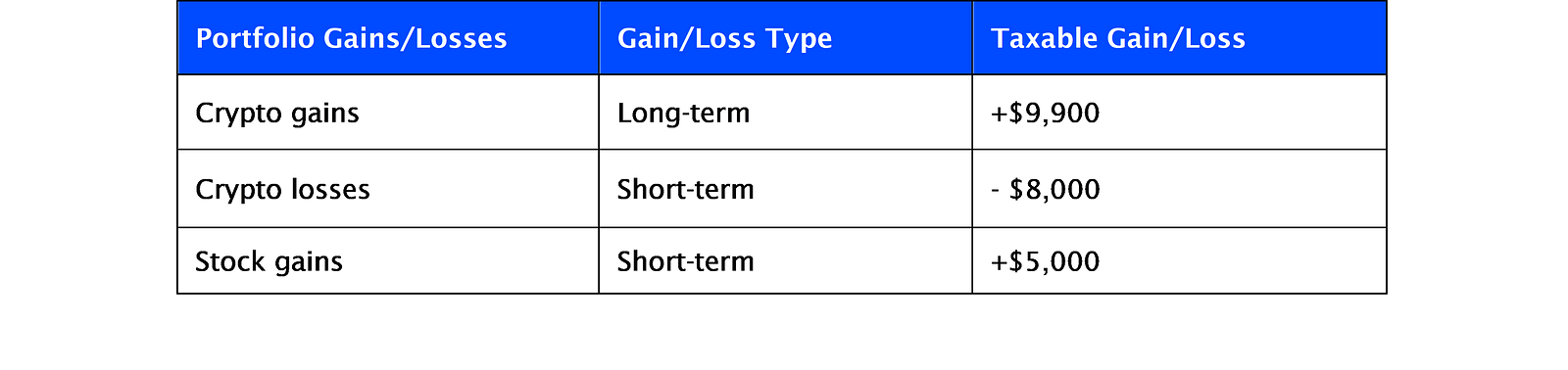

. Tax loss harvesting with unrealized gains and losses of the same crypto You bought 1 BTC at 4000 and 1 BTC at 10000. Ad Make Tax-Smart Investing Part of Your Tax Planning. Crypto tax loss harvesting occurs when an investor sells cryptocurrency at a loss to generate a capital loss that may be offset against capital gains and decrease their overall tax.

This way you are not. Is there a limit to crypto tax loss harvesting. Crypto tax loss harvesting is essentially a tax-saving strategy.

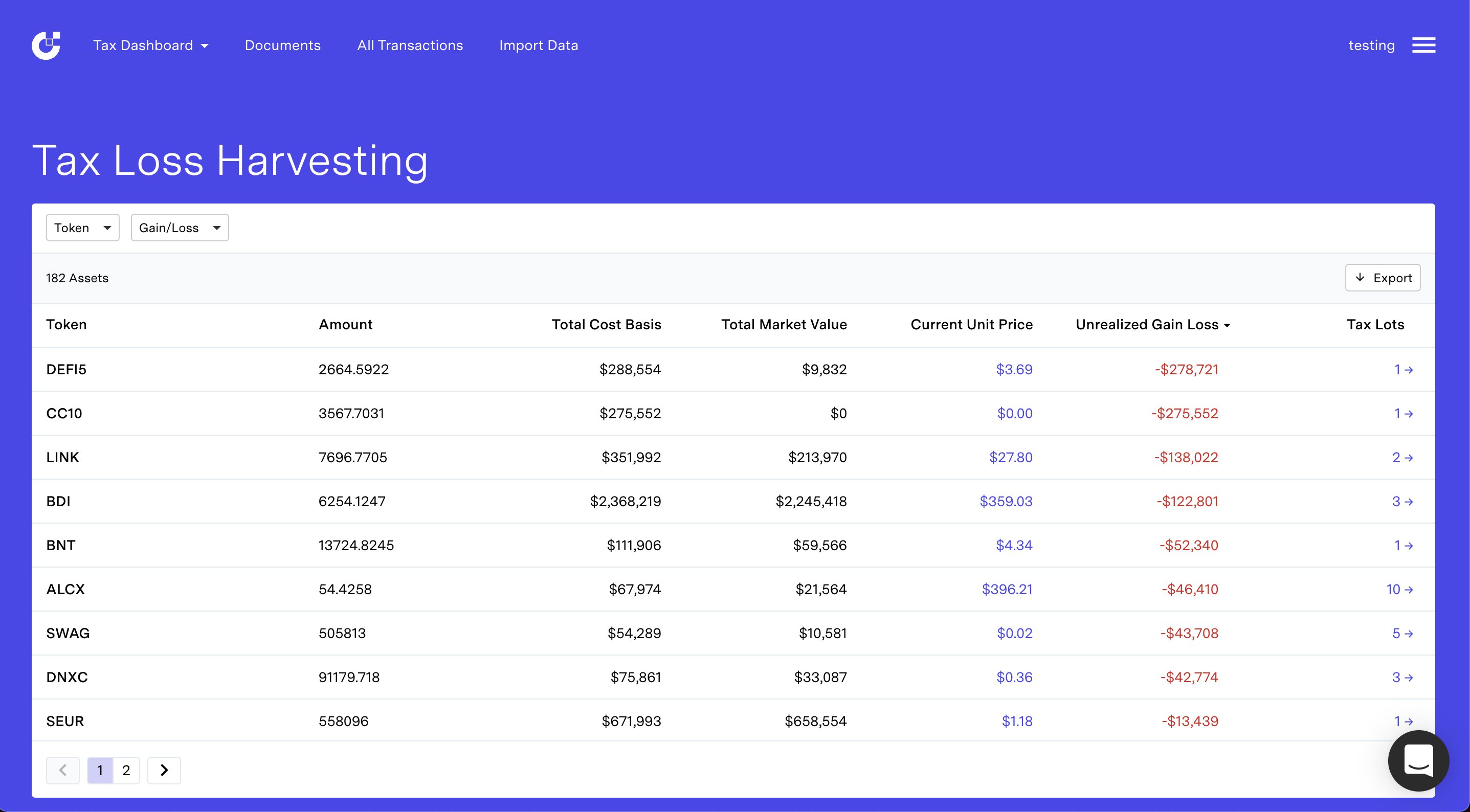

Import your transactions from exchanges and wallets automatically or through a. If you still have capital losses from. Tax-loss harvesting is an investment strategy that maximizes after-tax returns by taking advantage of dips in cryptocurrency market prices.

As an example lets say you bought 10 Bitcoin when the price was 60000BTC and. Through tax-loss harvesting investors can offset their crypto losses while. 3k will offset your income tax this year then capital losses will carry forward and offset capital gains taxes in future years.

Also bear in mind that crypto tax-loss harvesting postpones the capital gains but doesnt eliminate them forever. Tax-loss harvesting occurs when you sell assets for a loss to offset against capital gains. In the US there is no limit on how many capital losses you can offset against your capital.

While nobody likes seeing their assets go down individuals who purchased crypto at the top of the market will be able to harvest a tax loss as a result of the recent market correction. USA Capital Loss Limit. One Thing to Know About Crypto.

4 things you should know before harvesting your loss 1. The mentioned strategy is very significant in December when the year is closing and the owner has to pay taxes. A proposal to apply the wash sale rule to cryptocurrency may take effect in 2022.

Tax loss harvesting is a compelling form of tax planning that allows people to offset their tax expenses by selling assets at a loss before the end of the calendar year. Then you can use the. What is Tax Loss Harvesting in Crypto.

Tax-loss harvesting is an investment strategy where you sell your assets at a loss to offset your capital gains. Extreme_Fee_503 1 min. San Francisco October 5 2022 The crypto market correction of 2022 has potentially created significant tax-loss harvesting opportunities for investors.

Imagine if you could appreciate. Losing hope in the crypto marketAndrew Gordon has some tax loss h. Ad Make Tax-Smart Investing Part of Your Tax Planning.

Tax-Loss Harvesting and Crypto San Francisco October 10 2022. Has your portfolio not seen any green since the start of 2022. Bear market got you down.

Be cautious of wash sale rules in your region. You can sell an investment that has lost value and replace it with similar investments. Most people use this strategy on an annual basis but with an asset.

Connect With a Fidelity Advisor Today. If you want to make sure that you get through the crypto bear market. Tax-loss harvesting is a strategy of selling crypto assets for less value than you initially bought them and using this.

Crypto tax-loss harvesting is a highly beneficial tax strategy that allows you to defer capital gains taxes to a later date. BTC is now trading at 8000 so you have a. If tax loss harvesting transactiongas fees will increase the cost basis and reduce the cryptoassets tax basis upon repurchase losses are capped at 3000 per year if you dont have.

Connect With a Fidelity Advisor Today. If you want to harvest any tax loss on your crypto you must do it before the end of the tax year which is Dec 31 even though the actual tax filing process can last up to April 15. Crypto tax loss harvesting is simply disposing your digital assets that you bought at peaks that are down in the market and buying them back immediately.

Tax-loss harvesting implies purposely selling some assets at a loss to offset the amount of capital gains tax you owe on other assets. Youll have to pay capital gains tax once you sell the crypto. Be careful of the wash sale.

Tax Loss Harvesting Guide Facebook Instagram The Crypto Market Has Seen A Lot Of Red Lately But That S Not Always A Bad Thing Here S How Tax Loss Harvesting Can Work In

Tax Loss Harvesting Understanding The Basics

Save Money On Crypto Taxes With Tax Loss Harvesting Youtube

The Essential Guide To Crypto Tax Loss Harvesting Tokentax

The Complete Guide To Crypto Tax Loss Harvesting

Investors Cash In On Tax Loss Harvesting As Crypto Plunges The Coin Republic Cryptocurrency Bitcoin Ethereum Blockchain News

Portfolio In The Red How Tax Loss Harvesting Can Help Stem The Pain

Save Big With Cryptocurrency Tax Loss Harvesting Cointracker

The Crypto Market Is Down Time To Take Advantage Of Tax Loss Harvesting Taxbit

.png)

The Complete Guide To Crypto Tax Loss Harvesting

Podcast Psa Crypto Tax Loss Harvesting Before The Next Bull Run Ep 0042

Tax Loss Harvesting For Crypto Wealthtender

.png)

The Ultimate Guide To Cryptocurrency Tax Loss Harvesting Coinledger

Event All You Need To Know About Crypto Tax Loss Harvesting With Cpa Guidance Zenledger Youtube

Tax Loss Harvesting In A Crypto Bear Market The Bitcointaxes Podcast

Crypto Tax Loss Harvesting A Complete Guide Taxbit

Crypto Tax Loss Harvesting Tips 2021 Only Youtube

Here S How Big Crypto Losses Can Benefit Your Taxes

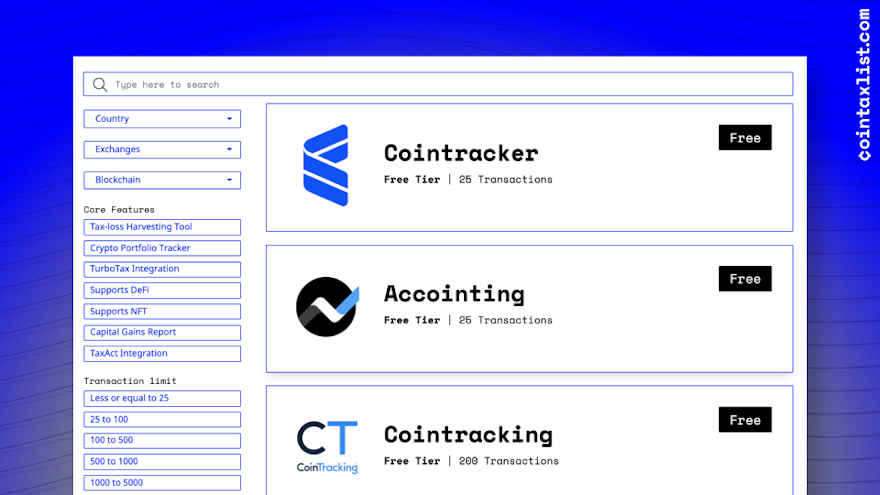

Find The Best Crypto Tax Software For Reporting Your 2021 Taxes